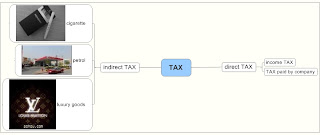

TAXes:

The money which government use to improve health,education,and sort of problems is tax

Category of Tax:

direct TAX:tax which get from the percentage of people`s income and company and cannot avoid.

As we know, people and salary monthly,but they must pay income tax at the same time.This is one way where government get the money from in order to something else to improve specific section.In China the start point is 1600 yuan(160pound),but as your income increase your income TAX will increase as well....income TAX is the one of the main TAX government used to get money from,it plays a important role in government.

Also,company should pay direct TAX as well,it is the percentage of your company profit.Big company pay thousands and thousands TAX to the government.

indirect TAX:a tax levied on the goods and services

another essential TAX is indirect TAX,which we can see it everywhere.Whenever we go shopping and buy something we may noticed that there is VAT(value added tax)a part of the indirect TAX in the end of receipt,in UK is has reduced to 15%.In some luxury goods,such as cars,clothes...etc..government will higher the TAX for controlling.As for cigarette,UK government has higher the TAX,the tax is even more that cost.Furthermore according to the elasticity if higher the TAX on cigarette ,consumer will pay more(inclasticity) the reason why government do that is because it cause negative externality(which affect third parties)it is harmful for our normal life

But it`s not easy to control people not to smoke by using TAX on cigarette,because it`s inelasic even the TAX is high and price is increase,people are likely to buy it as normal.